From King Arthur to Indiana Jones, tales of the hunt for the Holy Grail are legion. The mystical artefact, which made its first appearance in a late 12th century poem by Chrétien de Troyes and which Robert de Boron subsequently claimed was Jesus Christ’s drinking vessel from the Last Supper, has since made countless appearances in literature, art, music, TV shows, movies and even video games. But it continues to prove elusive – much like the most sought after treasure of the food world, the ultimate healthy snack.

Indeed, the Holy Grail of snacking – a product that doesn’t pile on the pounds, boosts wellbeing, keeps you fuller for longer and delivers on indulgence – has turned into something of a quest for suppliers. And their search has become even more urgent of late, with a government crackdown on high fat, salt and sugar (HFSS) products looming. From April 2022, those items will face strict advertising restrictions under plans confirmed in the Queen’s Speech this week.

On the face of it, the new rules are simple enough. The definition of HFSS will be based on the FSA’s Nutrient Profile Model scoring system. Points awarded for ‘C’ nutrients (fruit, vegetables and nut content, fibre and protein) are subtracted from ‘A’ nutrients (calories, saturated fat, sugar and sodium). Food scoring four or more points and drinks scoring one or more will be thrown on the HFSS pile.

But the reality is more complex and controversial. Because while some ‘healthier’ snacks will escape the new rules – Halo Top Birthday Cake ice cream, for example – many more will be classed as HFSS. Those include Walkers Oven Baked Roast Chicken & Thyme crisps, Proper Lightly Sea Salted popcorn and Cadbury Dairy Milk 30% Less Sugar.

It’s understandable, then, that many in the food industry disagree with the government’s rationale. After all, the definition of ‘healthy’ is a moveable feast, meaning different things to different people.

So what do shoppers and suppliers consider to be healthy? How does that chime with the upcoming government regulations? And will the new rules help or hinder the search for grocery’s Holy Grail?

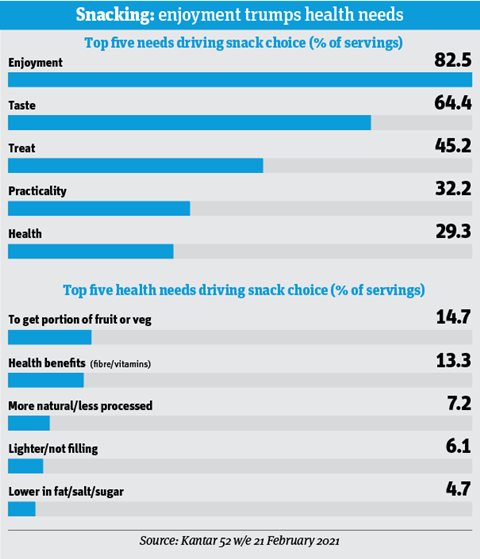

Even without the stick of regulation, health is an important carrot for Brits. It drove 29.3% of snacking choices in the past year [Kantar 52 w/e 21 February 2021]. And in some ways, the HFSS definition is hitting the right note. Lower fat, salt and sugar levels are a consideration in choosing healthy products, according to Kantar, as is calorie control.

The nutrient profile also awards positive points for fruit and veg content, which chimes with public perceptions of health. A main health driver of Brits’ snack choices “is to get a portion of fruit or veg” says Kantar strategic insight director James Foster – and 14.7% of food servings were chosen for this reason in the past year.

- Enjoyment is the top driver for snacking choices, accounting for 82.5% of servings.

- Meanwhile, health needs drive 29.3% of snacking choices. Within these, the main health driver is to get a portion of fruit of veg.

- Health benefits, such as snacks with fibre and vitamin claims, came a close second, accounting for 13.3% of health-driven needs. This mirrors the growing functional trend across the wider food and drink categories.

- Snacks that are ‘more natural/less processed’ account for 7.2% of health-driven snacking occasions.

- Snacks that are lower in fat, salt and sugar account for just 4.7% of health-driven snacking choices, suggesting that the HFSS ban is somewhat at odds with consumers’ perception of what is healthy.

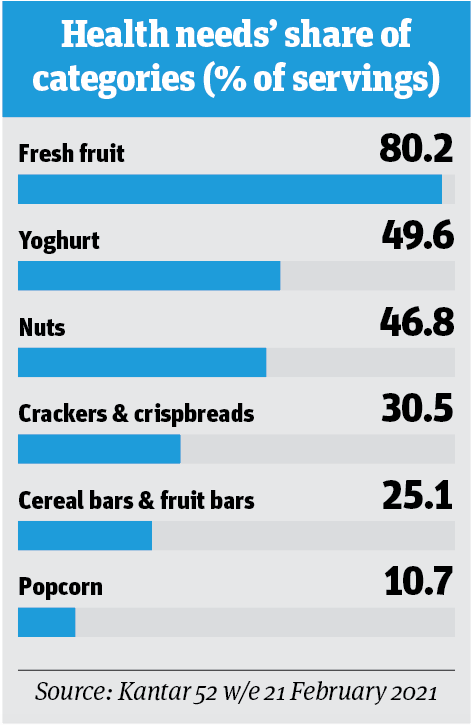

- Brits seeking a healthier snack are more likely to turn to the fridge, according to Kantar strategic insight director James Foster. “A fresh or chilled snack is almost twice as likely to be considered ‘healthy’,” he says.

- Nuts and yoghurts are viewed as healthier snack choices, Foster adds, with these categories chosen almost half of the time as a snack by consumers when a health need features.

Nut content

But when it comes to what shoppers are actually choosing as a healthy snack, a schism emerges. “Nuts and yoghurts are considered healthier snack choices by consumers,” points out Foster.

It’s a pertinent point given that many yoghurts fall foul of the HFSS definition, and the naturally high content of nuts means many nut-based snack bars go the same way. Almonds, for instance, contain close to 50g per 100g, meaning their inclusion in snacks risks them being slapped with restrictions.

It’s on this point that Mars-owned snack bar brand Kind has declared war. As The Grocer revealed this month, it plans to lobby the government to change the classification of all products containing over 50% nuts from confectionery and cereal bars to nuts and seeds, which would make them exempt from the HFSS crackdown. “At the very least we have over 50% whole nuts in our bars. Yes, that is high in fat but it’s a healthy fat,” says UK marketing director John McManus.

“We have over 50% whole nuts in our bars. Yes, that is high in fat but it’s a healthy fat”

That message seems to have got through to consumers, with Kind racking up a 22% rise in sales to £17.3m [Nielsen 52 w/e 5 September 2020]. So although it’s relaunching its breakfast range in three HFSS-compliant variants, it is reluctant to reformulate its core range, which largely falls on the wrong side of the definition.

The brand isn’t alone in arguing the benefits of nut-based snacks. British Heart Foundation dietician Victoria Taylor points out nuts have a high protein and fibre content, as well as being a source of vitamin E, potassium and magnesium.

That’s why they form a core part of many of the healthy snacks on the market. Think Perkier’s range of peanut-based bars and protein balls, and Deliciously Ella’s salted chocolate dipped almonds.

Then there’s ‘super fats’ brand Fatt, whose ketogenic bars, bites and cookies pack in almonds, macadamias and pecans “with a salty edge that satisfies for hours”. They’re also “high in good fats and inulin, a prebiotic fibre” says the brand’s founder, Hannah Sutter. These credentials seem to be increasingly important ones to shoppers.

“People are closely analysing the nutritional profile and ingredients of healthy snack products to ensure they are making the best snacking choices that deliver functional benefits,” says Sutter.

Functional snacking

This is another contentious point. When it comes to snacks, “it’s worth remembering that ‘positive’ health choices – adding something or offering natural benefits – trump ‘managed’ health – reduced calories or lower fat, salt or sugar,” notes Kantar’s Foster.

“Positive health needs feature in almost a quarter of our snacks compared with managed health, which appear in one in 10.”

And yet the HFSS scoring system doesn’t give credit to the likes of vitamins, minerals or probiotics.

It goes against the founding principles of trendy snacks such as Insane Grain, whose potential has just netted it a £250,000 investment from Warburtons. The brand trades on its use of sorghum, an ancient grain that provides “1.8 times more iron than spinach and more potassium than a banana”.

“People are analysing the nutritional profile and ingredients of healthy snack products”

Co-founder & director Rushina Shah says these claims are increasingly crucial to health-conscious consumers. They expect their snacks to be “insanely nutritious”, especially as they become busier out of lockdown and may no longer have time for three meals a day, she says. “Consumers now seek products with gut health benefits, vitamins, minerals and immune-boosting properties.”

Other brands are also boasting added benefits. Take The Honest Bean Co, which touts its fava beans as a “nutritional powerhouse” of B vitamins, potassium and magnesium.

Meanwhile, Karma Bites founder Ashwin Ahuja points to the use of saffron in its range of popped lotus seeds, purported to have mood-enhancing qualities, and kombucha squash, which is “packed with fibre, nutrients and vitamins”.

On that same basis, pulses have emerged as a key ingredient for healthy snacking brands. The NHS recommends them as a “cheap, low-fat source of protein, fibre, vitamins and minerals” – making them an ideal alternative to potatoes for crisp-style snacks.

Shoppers seem to be responding accordingly. Eat Real’s lentil chips, for instance, achieved the free-from brand’s biggest uplift last year with value sales up 48% to just over £5m [Nielsen 52 w/e 30 January 2021].

The level of innovation in pulses also points to their potential. In March, Bel UK bolstered its range with Laughing Cow Blends – the signature cheese spread blended with chickpea and herbs. And later this month KP Snacks will launch Popchips Veg Vibes made from chickpea, rice and sweet potato – topped with “deeply satisfying flavours consumers don’t usually see in vegetable-based crisps” says the brand.

It remains to be seen whether Veg Vibe will dodge the HFSS definition. After all, other elements of the Popchips portfolio – the Thai Sweet Chilli variant, for example – would fall foul of the regulations.

But using veg is a good start. The HFSS rationale awards ‘positive points’ for the inclusion of fruit and veg, which is spurring on brands to innovate in this area.

Brands speak out against ‘blanket ban’ on HFSS promotions

Snack bar makers are critical of government plans to clamp down on HFSS promotions and advertising as part of anti-obesity efforts.

“Fundamentally we agree with the premise of the legislation – obesity is an issue – but removing choice from consumers isn’t necessarily the way to go about it. Education is the way to go about it,” says John McManus, UK marketing director at Kind, whose core range of nut bars will fall under the ban.

Other suppliers agree that providing consumers with better information to make healthier choices – instead of controlling their exposure to HFSS products – is the way forward.

“Snacking in itself is indulgence. It’s breaking beyond a traditional meal-time to treat yourself and having space for this won’t change,” says Cathy Moseley, founder of Boundless Activated Snacking.

“What will change, among brands and their consumers, is the need for information.”

Phil Greenhalgh, MD at Grenade, is among those calling for HFSS restrictions to offer “an exemption for products that provide healthier alternatives to traditional confectionery, particularly where products are marketed solely at adult audiences”.

By using a binary nutritional profile model that classifies products either as ‘healthy’ or ‘less healthy’, “the government is undermining the very purpose of its own obesity strategy, making it harder for consumers to make healthier food choices” Greenhalgh insists.

The implications for retailers are no less serious than they are for brands.

Unless retailers find “healthy, non-HFSS alternatives that do not compromise on taste/indulgence – at a mass-market affordable price – they could risk losses, especially to the biggest snacking group: children” believes Rushina Shah, co-founder and director of Insane Grain, whose snacking range is fully HFSS compliant.

With Kantar data revealing that ‘enjoyment’ is the key driver for snacking choices, brands and retailers may have their work cut out to fall within the HFSS restrictions and keep shoppers engaged.

“While reformulation may come into play for some brands, it is imperative that they do not compromise on taste,” sums up Greenhalgh. “This will be the challenge.”

Five a day

Take Urban Fruit’s Wellness range, launching next month. Each pack of blended bites includes up to six fruits, such as mango, pineapple and strawberry.

The brand believes it can dodge HFSS rules while still appealing to shopper tastebuds. “You feel like you’re being indulgent without compromising on taste or health cues by adding in chocolate,” says Urban Fresh Foods marketing director Jo Agnew.

On the flip side, even brands that do add chocolate are feeling hopeful. Whitworths brand & e-commerce controller Baz Goode says the inclusion of white chocolate in its calorie-controlled Shots range of nuts and dried fruit allows for “permissible indulgence” to “reward” a healthier choice.

Regardless of what government rules may say, he believes this compromise is what pulls in the punters. “Sure, there are even healthier snacks out there that might be lower on calories per serving, but the shots are a go-to snack offering just the right balance of taste and nutrient value,” Goode adds.

He has a point. After all, Kantar’s data shows enjoyment as the leading motivator in snack choices, driving 82.5% of occasions. So even if a snack can dodge HFSS restrictions and tick every health box – low in sugar, fat and salt, and high in fruit and protein – shoppers simply won’t buy in if the taste isn’t there.

Taste cues

That’s why many players think it is worth adding in some elements of indulgence. Kind, for example, is sticking with ingredients such as salted caramel, sea salt and dark chocolate, which it believes can be healthy in the right doses to add a “flavour hint”.

It’s a similar story at Icelandic-style skyr brand Hesper, which communicates that taste element through ingredients such as cold brew coffee and vanilla. Founder Sam Moorhouse believes foods “that have a number of health benefits can bring touches of indulgence through flavours (chocolate, coffee, fruits) and small amounts of ingredients like sugar, to give a more balanced offering to consumers as well as being more HFSS-safe”.

Eat Real also hammers home the importance of taste, especially in the current climate. That’s “not only because lockdown sharpened people’s focus on health and wellbeing, but because social restrictions mean they’re now looking for their snacking experiences to deliver bigger and better taste adventures” says the brand’s marketing director Helen Pomphrey.

Her comment about social restrictions is an important one given the stresses and strains of the past year, suggests Adrienne Burke, marketing manager for snacking at General Mills, which makes Fibre One bars. “There will always be demand for indulgent options, especially in difficult times when people need a pick-me-up,” she says.

“Over a third of consumers are treating themselves more than ever. Treats just need to be ‘worth the calories’ – shoppers are demanding premium ingredients and innovative formats.”

Health needs’ share of categories

Shoppers seeking health-focused snacks are almost twice as likely to head to the fresh fruit aisles than to chillers for yoghurt

Chilled snacks

This time at home is allowing shoppers to get these treats in different ways, too. Kerry Foods brand Fridge Raiders says the “fridge is now being perceived as a permissible zone for snacks”, as a growing number of consumers work within an easy walking distance of their kitchens.

That’s helped the brand deliver 17% sales growth year on year, says Victoria Southern, marketing & category director at Kerry Foods. “In the last 12 weeks that has escalated further to 33%,” she adds.

As a bonus, chilled snacks benefit from a health halo: a fresh or chilled snack is almost twice as likely to be considered ‘healthy’ than an ambient one, according to Kantar.

“The fridge is now being perceived as a permissible zone for snacks”

So it seems the picture is a complex one. In the post-Covid era, shoppers are demanding more benefits from their snacks and consuming them in different ways. By focusing on a relatively narrow definition of health, the new HFSS rules arguably risk undermining the innovation needed to deliver those products.

Thankfully, suppliers appear undeterred in their quest to make products that deliver not only on health, but on taste. “From a shopper perspective, we believe the brands which will be the most successful will be those who are able to bridge the gap between better-for-you nutrition credentials and a perception of indulgence,” says Kind’s McManus.

And for now, that may be the closest thing snack brands will get to the Holy Grail.

Retail potential for healthy snacks

Gone are the days when shopping for healthier snacks was a special mission. Buoyed by consumer demand, suppliers have been able to broaden their reach across channels.

Take e-commerce. Last month, Kind kicked off its direct-to-consumer offer, which the nut bar brand will use to launch its first online exclusive – a Dark Chocolate Ginger Almond variant in a multipack of six.

The recent DTC boom across grocery has been a boon for snack brands, suggests Victoria Southern, category director at Fridge Raiders owner Kerry Foods. “We’ve seen phenomenal growth in e-commerce as a business overall. We’ve got more people shopping online than ever,” she says.

The mults are also tapping online’s popularity in snacking. Sainsbury’s, for instance, allows shoppers to browse virtual aisles that feature “200 calories or less snacking”.

But in physical stores, dried fruit snack brands, such as Urban Fruit are still tucked away in the baking section. It could be time for retailers to rethink in-store positioning of healthy snacks, in line with their virtual equivalent.

Research commissioned in 2020 by Proper revealed 55% of people want more healthier snacking options at front of store. “So it’s more important than ever that brands and retailers reflect this trend with a better-for-you offer that delivers on both health and taste,” says Proper founder Cassandra Stavrou.

Helen Pomphrey, marketing director at Eat Real Snacks, believes shoppers “will expect to find a wider range of healthier options within the mainstream snacking aisles” as demand grows.

Innovations in healthier snacking 2021

The Holy Grail of snacks: healthier snacking category report 2021 - The Grocer

Read More

No comments:

Post a Comment