From L to R: Shoumill Tripathi (Head - Ecommerce), Anish Basu Roy (Co-founder CEO) and Sagar Bhalotia (Co-founder) Image:

From L to R: Shoumill Tripathi (Head - Ecommerce), Anish Basu Roy (Co-founder CEO) and Sagar Bhalotia (Co-founder) Image:

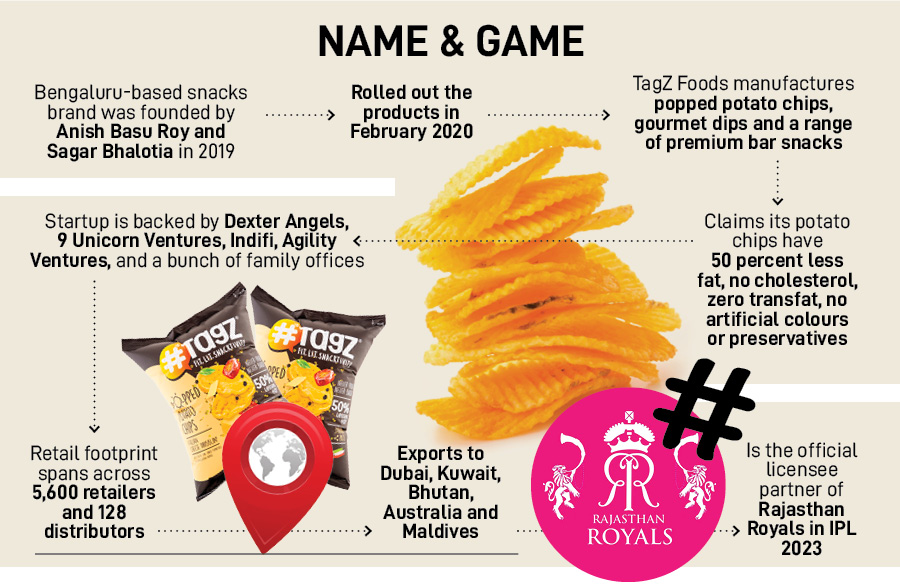

Second doubt originated from the price positioning of the rookie snacks brand. When TagZ was rolled out in February 2020, a 30-gram pack carried a price tag of Rs 50. ‘Will prohibitive pricing give it a mass appeal’ was another question hurled at the co-founders. Third layer of scepticism had its roots in the dismal track record of a lot of healthy snacks brands that started with a bang but soon got popped out. ‘Will TagZ survive or can it change the history’ was also a right query. Last, the co-founders had made their intention clear to defy the conventional marketing wisdom, which was grounded in the logic of ‘less is better’. Roy, for his part, had made it crystal clear that he won’t make TagZ a one-product and solo-category brand. “If you want to grow big, then you can’t be just one product or segment,” he argued. The argument, interestingly, didn’t have many takers. ‘They will end up biting more than what they can chew’ was the concern of the critics.

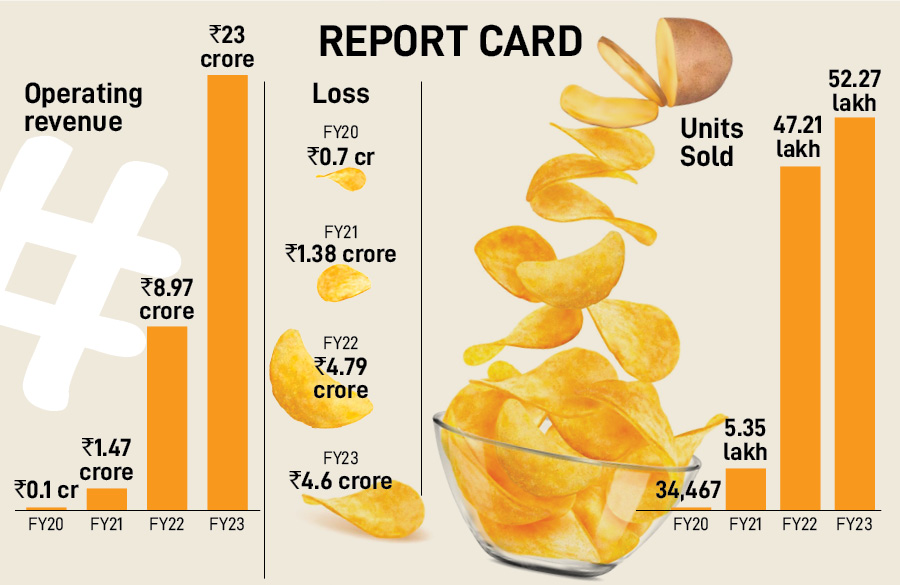

Cut to May 2023. TagZ has clocked Rs 23 crore in operating revenue and has a loss of Rs4.6 crore. Though apparently small, the numbers look impressive if one views them in the context of where the brand was when it started. Let’s start with the revenue bit. It has jumped from Rs10.34 lakh in FY20 (and this was a truncated fiscal year as the brand was rolled out in February) to Rs1.47 crore the next fiscal and then Rs8.97 crore in FY22. Overall, in four years, the brand has grown by 230 times. In contrast, the losses during the same period have an interesting trend of pole-vaulting in the first two years and then not ballooning: From Rs70.22 lakh it went to Rs1.38 crore and to Rs4.79 crore. “It’s snacks’ time, folks,” says Roy, who has so far raised $3.2 million from a bunch of investors such as Dexter Angels, 9 Unicorn Ventures, Agility Ventures, Namita Thapar, Ashneer Grover and Ranvijay Singha.

Roy explains what has worked for the brand. Top of the chart comes sharp positioning. TagZ, he underscores, was born to cater to the needs of the Generation Z, which comprises people born between 1996 and 2010. It’s a generation which cares for health, environment and planet. “The problem of ‘too many players’ was in fact an opportunity for us,” he says, adding that most of the snacks brands, especially the chips and wafers ones, were nothing but me-too with a slight change in optics. Second factor fuelling sales was not chasing investors. He decodes the aberration. “We knew if the product cracked, it will have both consumer and investor pull,” he says. In February last year, TagZ Foods announced a Consumer Stock Option Plan (Csop) to raise funds with minimum investment ticket size at Rs5,000. The round was over-subscribed by 756 times. “For an entrepreneur, the biggest satisfaction is when consumers back you. Some 3,400 guys invested,” he claims.

Also read: When food marketers don't listenThe third lever of push came from rationalising the cost. From Rs50 for a 30-gram pack, TagZ now sells a 25-gram pack for Rs30. “The price will come down only when the volume increases,” he says. From 34,467 packs sold in FY20, the numbers have leapfrogged to 52.27 lakh in FY23, claims Roy, adding that last year the brand launched dark chocolate centre-filled Hemp cookies and now exports products to countries such as Dubai, Kuwait, Bhutan, Australia and Maldives. “You can’t have aspiration to become a Rs1,000-crore brand by just being in one category and one country,” he reiterates.

The backers are elated with the performance of the new chip off the block. “I truly believe that TagZ has a significant potential to go on to become a truly international brand,” reckons Namita Thapar, executive director of Emcure Pharmaceuticals. Snacking, she underlines, is a massive market opportunity in India and the need for fitter options is growing rapidly. “TagZ has started owning the narrative in this space,” she says, adding that its urban GenZ positioning and focus on launching innovative products using deep food-technology is showing results. “The brand balances fitter snacking options without compromising on taste,” she adds.

Though TagZ has grown at a brisk pace, marketing and branding experts reckon that the going might be challenging. The first big challenge emerges from scaling the brand beyond a point. “Its sharp positioning itself is a double-edged sword that might limit its appeal,” reckons Ashita Aggarwal, marketing professor at SP Jain Institute of Management and Research. Consumer brands, she maintains, must stay away from getting tagged. “Anybody can be your consumer,” she says, adding that only talking to Gen Z comes with the risk of letting go a significantly bigger chunk of consumers outside that age cohort. “Apple is for all. So is Coke and Lays,” she says. The second challenge for the brand would be offline scaling. “A limited brand awareness will be an obstacle,” she says. Brands are not only about high-quality products but also about high awareness and presence. “Ultimately, you have to take on the big boys of chips when it comes to competition,” she says.

Roy, for his part, is confident of having the right set of chips. “TagZ is the OTT equivalent of the snacking space,” he says. On one hand, TagZ is challenging mass brands, which are the equivalent of single-screen cinema, and on the other, it's dislodging the healthy snacking brands—Roy calls them theatre--which don’t score high on taste. “We are not in a hurry to conquer and scale the entire country,” he says. Looks like the founder has gauged the snacking appetite habit of the Indians. “Snacks are had either once or twice a day, and in small portions,” he says. The same logic holds true for business as well. “Slow and steady,” he signs off.

Check out our Festive offers upto Rs.1000/- off website prices on subscriptions + Gift card worth Rs 500/- from Eatbetterco.com. Click here to know more.

Chip(s) Thrills: How TagZ is cracking the snacks market - Forbes India

Read More

No comments:

Post a Comment